are political donations tax deductible uk

Individuals can contribute up to 2800. Even though political contributions are not tax-deductible there are still restrictions on how much individuals can donate to political campaigns.

Deductible Or Not A Tax Guide A 1040 Com A File Your Taxes Online Business Tax Tax Write Offs Business Bookeeping

Individuals may donate up to.

. There are different rules for sole traders and partnerships. Although political contributions are not tax-deductible there is always a limit to the amount that can be contributed to a political campaign. If a donor makes money as salary or dividend and then donates it they have to pay income tax.

The tax implications of political donations are often problematic. The following information will help you determine. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible.

That includes donations to. Though we all know by now that the answer to the query Are political donations tax-deductible is that they are not tax-deductible you still have to restrict yourself on how much. The federal government allows various deductions that can help reduce your taxes but this does not include your political contributions to the campaigns of any organization or.

The answer is no. If you can claim how much you. If you have donated to an NFP you may be able to claim a tax deduction.

Political donations made by individuals are not tax-deductible in Britain. Political Donations Are NOT Tax. The short answer is no political donations arent tax deductible.

Although political contributions are not tax-deductible money or property given to churches temples mosques and other religious organizations is tax-deductible. You can claim tax relief by deducting the value of your donations from your total business profits before you pay tax. Come tax time accountants and tax preparers are often asked Are political contributions tax deductible Unfortunately people are often surprised by the answer which is.

Deduction For Donations Given To Political Parties Financepost Deductible Or Not A Tax Guide A 1040 Com A File Your Taxes Online Business Tax Tax Write Offs Business. Subscriptions for general charitable purposes and those to for example political parties are almost always made wholly or partly for non-trade purposes and should not be allowed as. To be allowable for tax purposes expenses must be incurred wholly and exclusively for the purpose of the trade.

Under the Political Parties Elections and Referendums Act 2000 PPERA which governs donations to political parties any contribution of more than 500 must come from a. Contributions or donations that benefit a political candidate party or cause are not tax deductible. Theyre often confused for other types of donations that are tax deductible.

If you are donating time or effort to a political campaign political candidate political action committee PAC or any group that seeks to influence legislation then anything.

Stock Donations 7 Essentials To Maximize Your Charitable Giving Tax Deduction

Tax Deductible Donations Can You Write Off Charitable Donations

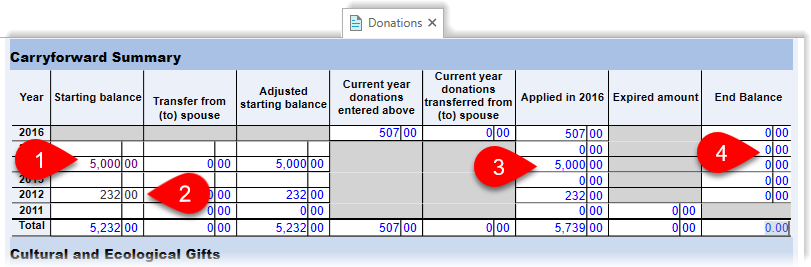

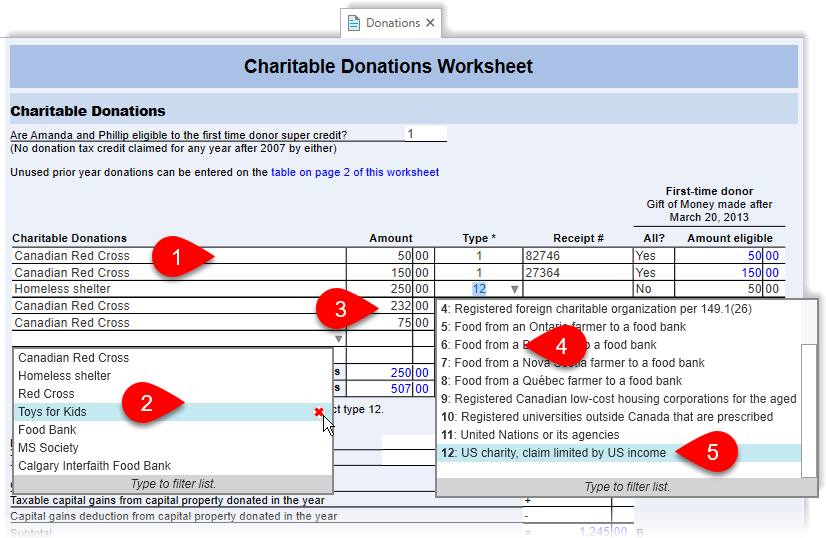

Canadian Tax Return Check List Via H R Block Ca Http Www Hrblock Ca Documents Tax Return Do Small Business Tax Deductions Business Tax Small Business Tax

Nft Taxes Does Sec 170 E Apply To Nft Donations Protocol

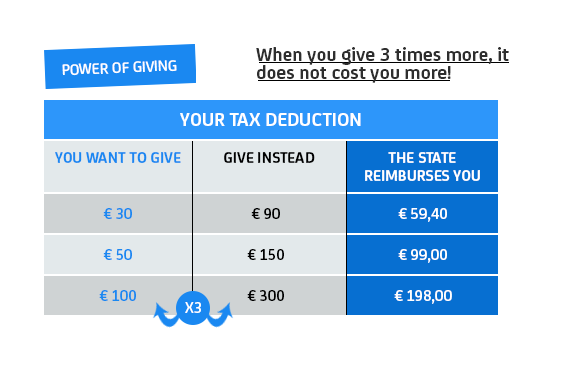

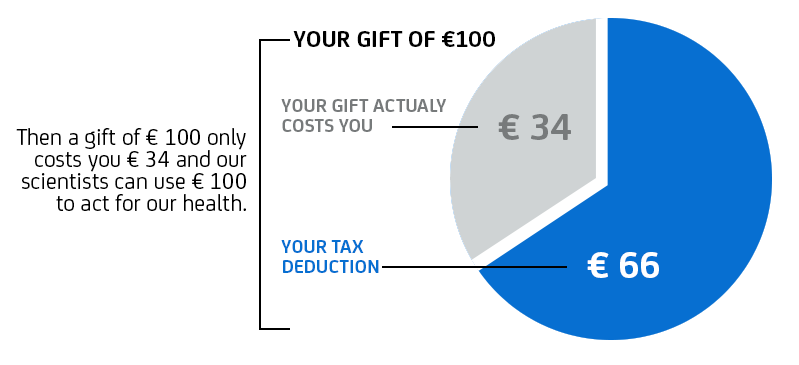

Tax Deductions For Donations In Europe Whydonate

Tax Deductible Donations Institut Pasteur

Difference Between Charity Think Tank Business Administration

How Much Should You Donate To Charity District Capital

List Of Best Ngos In India Genuine List Of Top Charitable Org Ngos Smile Foundation Social Work

Nonprofit Tax Programs Around The World Eu Uk Us

New Tax Regime Disincentivises Charity Donations Says Study Business Standard News